Transfer Pricing Example

Managing Master File Local File Transfer Pricing Documentation. This is substantially more expensive than the S3 Standard storage tier which costs between 0021-0023 per.

The Five Transfer Pricing Methods Explained With Examples

AS2 enabled on your endpoint.

. Use of Resale Price Method in practice. In this article we explain the Cost plus Method in more detail show an example and explain how and when it is used. How we calculate Effective Storage Price.

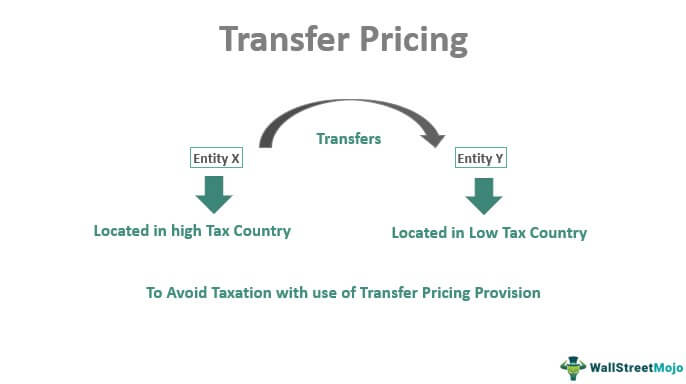

EBS Volume usage and also Data Transfer costs. The first step in avoiding audits and penalties is to make sure all required documentation is prepared on time. In taxation and accounting transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control.

Inbound data transfer is free and we offer a high threshold for free outbound data transferthe. Large user base with heavy use over multiple protocols. Transfer Pricing Documentation and Related Penalty Rules There are three types of penalties described in Internal Revenue Code IRC 6662e that may be imposed in the event of a substantial or gross valuation misstatement.

Applying the arms length principle is generally based on a comparison of the prices or profit margins that non-arms length parties use or obtain with those of arms length parties engaged in similar transactions. For example consider a situation in which Company B a member of an MNE group needs additional funding for its business activities. Data transfer fees and storage costs on Amazon S3 which are different from standard S3 pricing.

Data and research on transfer pricing eg. Read more to the tire division will be 82 battery. For example a taxpayer cannot rely on an unreasonable selection or application of a specified method to avoid.

030 24 hours 30 days 216. Transfer Pricing Asia. For example transactions between a parent company and its related parties are subject to transfer pricing rules.

In other regions prices vary slightly for example in the EU London region the price is 0053. The Resale Price Method requires that third party transactions are comparable with the controlled transaction. Snapshot pricing comprises two parts.

You can calculate the effective storage price for your region using the example below. Transfer pricing refers to the prices of goods and services that are exchanged between companies under common control. As a result there can be no differences that have a material effect on the resale.

Skip to primary navigation. In this example when using the Resale Price Method Apple Pear needs to charge a transfer price of 93 USD to its associated distributors. RDS data transfer pricing may vary per database used.

Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations transfer pricing country profiles business profit taxation intangibles In a global economy where multinational enterprises MNEs play a prominent role governments need to ensure that the taxable profits of MNEs are not artificially. As an example the data transfer line item would be labeled by a code such as USW2-DataTransfer-Regional-Bytes. In this scenario Company B receives an advance of funds.

See simple pricing for cloud networking DNS FastConnect Load Balancing and how the first 10 TB of data transfer per month are free. It is important to understand that the Cost Plus Method is one of the common transfer pricing methods used to examine the arms-length nature of. Transfer pricing continues to be a significant area of risk for HMRC and a major source of uncertainty for UK companies with international related-party dealings.

Guide to Transfer Pricing its Meaning. For example businesses use relevant costs in management accounting to conclude whether a new decision is economical. Use synonyms for the keyword you typed for example try application instead of software.

Find reference architectures example scenarios and solutions for common workloads on Azure. The enterprises OECD master file may for example be presented by line of business as long as centralized functions and transactions are thoroughly documented. We calculate your monthly AWS Transfer Family cost using pricing in the US-East-1 Region as follows.

At 030hour your monthly charge for AS2 is. Were in this togetherexplore Azure resources and tools to help you navigate COVID-19. For example a tax authority may increase a companys taxable income by reducing the price of goods purchased from an affiliated foreign manufacturer.

File systems using EFS Infrequent Access to transfer infrequently accessed files to IA storage Standard-IA or One Zone-IA have a lower effective storage cost per GB-month compared to file systems that do not use EFS Infrequent Access. Notice in the following table that there is a free pricing tier up to 1GBmo for data transfers into Amazon RDS. For Zone details please refer to FAQ below.

Data transfer pricing is based on the Zones. For example if a subsidiary company sells goods or renders services to its holding company or a sister company the price charged is referred to as the transfer price. Transfer pricing purposes would be a function of the maximum amount that an unrelated lender would have been willingto advance to Company B and the.

The Cost Plus Method with an example. Here we discuss purpose of transfer pricing risks with examples objectives how does it work. However the response to the consultation indicates that unless there is a material UK tax risk for example when entities benefit from oil and gas ringfencing or when there is.

The Transactional Net Margin Method Explained With Example

The Five Transfer Pricing Methods Explained With Examples

What Is Transfer Pricing A Clear And Simple Definition

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Meaning Examples Objectives Purpose

Transfer Pricing Definition Optimal Price Determination Examples

0 Response to "Transfer Pricing Example"

Post a Comment